If the state where you reside and work has this arrangement with the one where your company is based, you won’t owe taxes in both jurisdictions. Others have laws with a wage-based tax threshold, and nine states do not collect income taxes.Īnother important consideration, a few neighboring states have reciprocal agreements.

Twenty-three states mandate that you must begin paying the withholding tax on day one when you switch your tax residence. For example, some states permit nonresidents to work there for more than 30 days without a tax withholding requirement, i.e., Arizona and Hawaii allow you reside there for up to 60 days before the withholding kicks in. You may not have to pay more in taxes overall if your employer is located in another state because most states, but not all, provide a tax credit in these circumstances to avoid double taxation.ĭepending on the state, however, you may have to pay double withholding taxes or file two state tax returns if you are working in a different state during the year than where your company is based, or what is known as a change in tax residence.

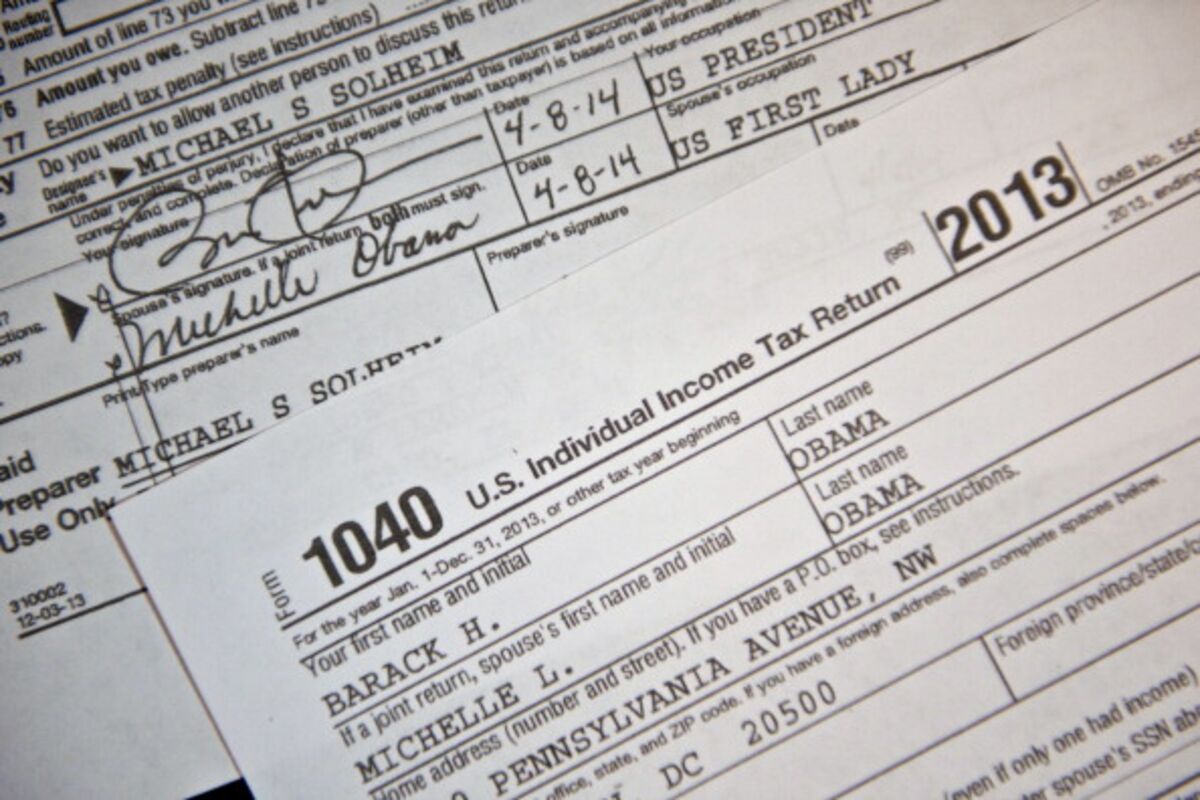

Learning your state’s tax rules is crucial because each state has different laws about reporting income earned by residents, even those who do not reside in the state year-round. Urban centers that experienced net outflows included San Jose-Sunnyvale-Santa Clara, Calif., San Francisco-Oakland-Berkely, Calif., New York, N.Y., and Newark -Jersey City, N.J.6 How Does This Impact Your Taxes? The Washington Post ran an article with the headline “Great American Migration of 2020” in March 2020 and predicted it “might contain the sides of a wholesale shift in where and how Americans live.”4 The article explained that many people were leaving bigger cities and moving to summer homes in other states, such as Rehoboth Beach, Del., a resort town with only 1,500 permanent residents but with a summer weekend population that can expand to 25,000.5 (Just like Sara’s hometown of Montauk, New York!)Īccording to a survey by Politico, the urban areas that gained the most residents during the pandemic were Austin TX, Phoenix-Mesa-Chandler, Ariz., Raleigh-Cary, N.C., and Las Vegas, Nev. The organization stated, “Remote work is here to stay, with 78% of employers indicating a hybrid office model will be their predominant post-pandemic policy, up from just 6% pre-pandemic.” And Some People Took “Remote” Seriouslyīeginning early in the pandemic, thousands of people in big cities such as San Francisco, San Jose, Boston, and New York City were stuck in small apartments and/or urban areas with the highest rates of COVID-19, moved to supposedly safer suburbs and countryside. According to a recent study by the Partnership for New York City, only 8% were working in the office five days a week.3 The organization found that the share of fully remote office employees dropped from 54% in late October 2021 to 28% as of late April. As of late April 2022, just 38% of Manhattan office workers were at the workplace on an average weekday. Nevertheless, research has discovered that many employees desire to continue working from home. That compares with an estimated 42% of workers working from home in June 2020, according to the Stanford Institute for Economic Policy Research.2 Among age groups, those 25 to 34 had a greater tendency to telecommute. According to a Bureau of Labor Statistics (BLS) survey released in May, about 7.7% of employees reported working from home.1 The BLS reports that more women are working remotely for pandemic reasons. How Many Workers are Doing This?Ī few studies have generated different results about the number of people who are still telecommuting halfway through 2022.

However, many of these workers may not know the tax implications of working remote in a different state than their company’s headquarters. Shortly after the pandemic began, many employees moved from larger cities with higher rates of COVID to the suburbs or smaller towns in other states to lower their costs or purchase a larger home. However, one aspect of society has not fully returned to pre-pandemic normalcy: remote work. It’s been two and a half years since the COVID-19 pandemic began, and most of the country is up and running: students have returned to classrooms, people are traveling for pleasure and business in record numbers, and spectators are back in the stands.

0 kommentar(er)

0 kommentar(er)